Analysis of Namibia's 2017 Borrowing Trends Shows Focus on Basic Needs

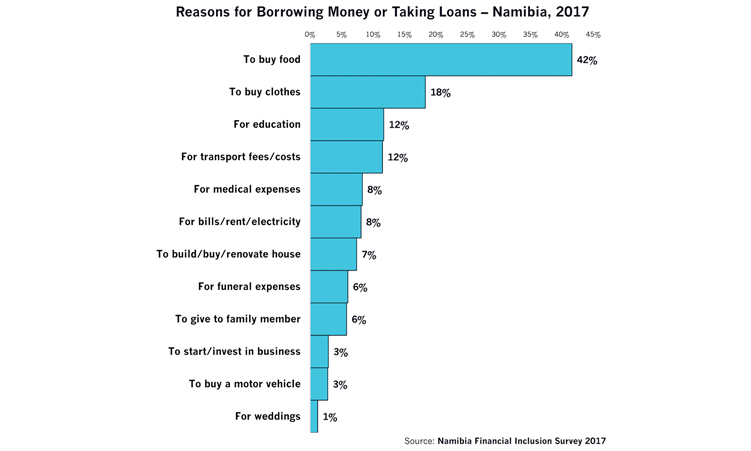

As Namibia prepares for the 2025 Financial Inclusion Survey, data from the 2017 baseline reveals significant insights into consumer borrowing behavior. The findings highlight a concerning trend where short-term survival needs dominated borrowing patterns, rather than long-term investments.

Key Borrowing Motivations in 2017

The survey revealed that 42% of borrowers primarily sought loans for food purchases, significantly overshadowing other categories. Additional borrowing purposes included:

- Clothing purchases (18%)

- Transportation costs (12%)

- Medical expenses (8%)

- Utility payments (8%)

Evolution Towards Productive Credit

Recent data shows encouraging shifts in borrowing patterns. The financial sector's transformation is evident in declining household overdrafts, which contracted by 11.2% year-on-year in August 2025.

Impact of Tax Reforms and Future Outlook

While tax reforms have influenced borrowing patterns, recent trends raise concerns. The postponement of inflation-adjusted tax brackets could pressure households back towards short-term borrowing for basic needs.

Current Challenges

Despite positive developments in long-term credit uptake, mortgage loan growth remains weak, failing to exceed 1% annual growth since November 2024. The momentum from tax bracket reforms appears to be waning, as evidenced by declining card transaction values and e-money transactions over the past six months.