New data from Namibia's financial sector reveals a significant evolution in consumer borrowing patterns, marking a potential transformation in the country's financial landscape as the 2025 Namibia Financial Inclusion Survey (NFIS) gets underway.

Historical Borrowing Patterns: A Focus on Basic Needs

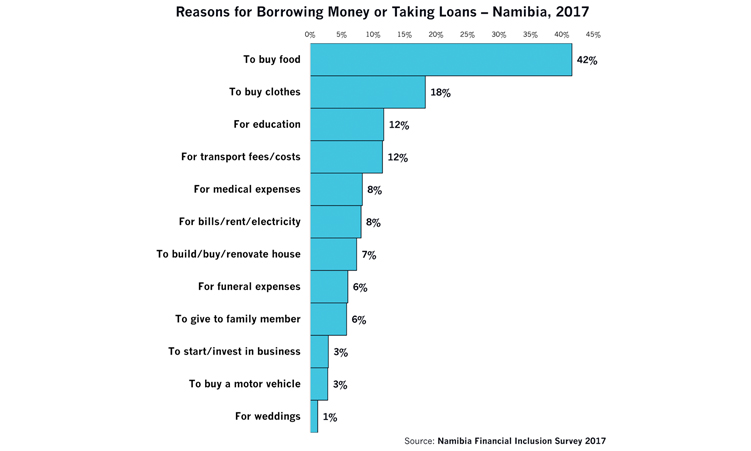

The 2017 baseline survey painted a concerning picture of Namibian borrowing habits. An overwhelming 42% of loans were taken out for food purchases, while essential expenses like clothing (18%), transport (12%), and medical costs (8%) dominated borrowing motivations. This trend aligned with broader regional challenges in sustainable financial development across Namibia.

Current Trends Show Promising Shift

Recent data indicates a notable transformation in household credit patterns, particularly following tax bracket adjustments. The most striking development has been the 11.2% year-on-year contraction in household overdraft credit as of August 2025, coinciding with ongoing discussions around tax reform and economic development.

Key Findings:

- Increased uptake of long-term, productive credit instruments

- Growth in installment and leasing arrangements reaching highest levels since 2015

- Shift from survival-based borrowing to investment-oriented credit

Challenges and Future Outlook

Despite positive developments, some concerns remain. Mortgage loan growth continues to struggle, failing to exceed 1% annual growth since November 2024. This mirrors broader economic uncertainties affecting market confidence and investment decisions.

The postponement of annual tax bracket adjustments to the next financial year could potentially pressure households back toward short-term borrowing patterns, highlighting the delicate balance between fiscal policy and financial inclusion.